Nano Dimension has announced its decision to discontinue ‘non-core product groups’ Admatec, DeepCube, Fabrica, and Formatec.

The products, which specialise in 3D printed ceramics, micro additive manufacturing and deep learning-based artificial intelligence, came from a series of acquisitions made by Nano between 2021 and 2022, long before the company became embroiled in subsequent M&A drama with Desktop Metal, which reached its conclusion last month (or perhaps not?) with a transaction valued at $179.3 million.

According to a letter from Nano Dimension’s newly appointed CEO Ofir Bahara following the publication of the company’s 2024 financial results, the moves, together with broader organisational efficiencies, have enabled the company to reduce annualised operating expenses of its core business by over $20 million and deliver a 52% increase in revenue per employee from $147,000 to $223,000.

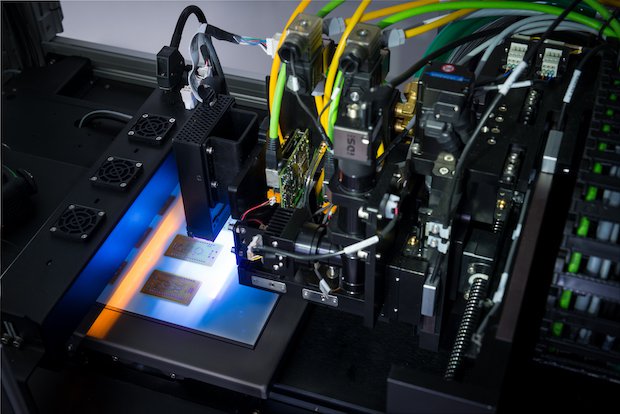

The letter describes the “hard look” the company had taken at its portfolio, which Bahara said included scrutinising “excessive G&A, including unwarranted management overhead”, breaking down silos, particularly in sales and marketing, and realignment of the organisation “around the customer”. The conclusion, per the letter, is “less hierarchy, more execution, and a flatter, faster organisation better equipped to innovate and deliver.” The company is now said to be focusing its efforts on two core product groups: Additively Manufactured Electronics (AME) and surface-mount technology (SMT).

Bahara also provided further comment on Nano’s Desktop Metal and Markforged acquisitions. While the company is still in the early stages of its review of Markforged, which closed in a deal worth $116 million last week, the letter highlighted Desktop Metal’s limited liquidity and significant liabilities, including but not limited to $115 million principal amount of outstanding convertible notes.

Bahara said, “Desktop Metal does not currently have liquidity or a financing commitment sufficient to fund the repurchase of the notes required by the indenture or satisfy its other material liabilities. Following our acquisition, we provided limited financing to Desktop Metal to help it address short-term liquidity needs and run a process to evaluate its strategic alternatives. No assurances can be given as to the outcome or timing of Desktop Metal’s strategic review process or our consideration of whether or in what amount to provide additional financing.”

The statement reinforces claims made last week that Nano is exploring ‘all strategic alternatives’ to address Desktop Metal’s liabilities and liquidity needs, which could lead to its divestiture, just weeks after its acquisition was completed.

Nano Dimension plans says it plans to host a strategic update in June 2025.