In Heidelberg, Germany, it was business as usual.

The polymer production line was pushing out materials for packaging and postage. The service bureau arm of the business continued to provide printed parts. Up the road in Frankfurt, public-facing employees were making connections, promoting products and highlighting application success stories.

Is that piquing your interest? Probably not. It’s the same few days any AM solutions provider can expect as half the team travels to an industry trade show and the other half holds down the fort.

But just because Forward AM was procuring leads at Formnext and fulfilling client orders back home, it doesn’t mean all was well. Less than five months after carving the company out of BASF, the Forward AM management team were filing for insolvency.

The company might have been presenting calmly in Frankfurt, but 50 miles away, there can’t have been the same composure. For the businesses that rely on Forward AM’s materials products or its Sculpteo service offering, there certainly wouldn’t have been.

The future of one of AM’s leading solutions providers was in doubt as insolvency proceedings were officially announced on November 26. And though Forward AM’s leadership explained it hoped to restructure the business and set it up for long-term success, there were many questions left unanswered.

Last month, TCT spoke exclusively to CEO Martin Back to get some insight on what’s going on at Forward AM, and what might come next.

Jumping in

But first, some background.

BASF’s additive manufacturing business was officially stood up in 2017, with the Forward AM brand being introduced two years later. Along the way, Advanc3D Materials, Setup Performances SAS and Sculpteo were acquired, with a slew of polymer materials – and a couple of metal filaments – being added to its product portfolio. Partnerships were also established with several polymer AM machine OEMs, including Stratasys, Nexa3D, Photocentric and Farsoon.

Though BASF was among the first of several chemical giants to step into the AM market with an official business unit, by 2024 the company was ready to narrow its focus on ‘core businesses.’ By now, it was felt that Forward AM had reached a level of maturity that could see it stand on its own two feet, spinning out as an independent entity and becoming a more agile business as it moved, well, forward.

Managing Director Back, supported by multiple investors, thus moved to acquire the business, as well as Sculpteo, from BASF. The plan was to continue much of the good work started within BASF, building on a consistent 30% annual growth rate, and providing new solutions to the market by harnessing a 90-strong family of IP that consists of more than 400 patents.

It was a bold step to make with the volatility in the rest of the AM market. M&A activity was ongoing, layoffs a regular occurrence, and several companies were filing for bankruptcy. Many of these instances were occurring as a knock-on effect from other manufacturing markets, where companies have been unable, or unwilling, to proceed with CapEx investments and explore new ways to manufacture their products. And as it stepped out on its own, there was nothing to suggest Forward AM wouldn’t encounter the same struggles.

But that’s not to say there wasn’t opportunity as well. As Back told TCT last month: “The broad industry needs support and help. We have so much need to adapt Western industrial manufacturing; the industry needs to learn and adopt new ways of making things. This is where we need to jump in.”

A new reality

Back and his colleagues did just that. And got off to a steady enough start.

Having thrashed out a deal with BASF, Forward AM had ownership of the Heidelberg headquarters within days and was able to immediately commence serving customers with ‘the same people, the same products, on the same system.’

But there were many complexities to the deal. Sculpteo, for example, was originally acquired by BASF New Business GmbH to sit alongside – not necessarily within – the Forward AM business, while work on the 90 IP families almost certainly commenced before the formation of BASF’s dedicated 3D printing business in 2017. What Back and his team were doing, then, was carving out disparate businesses and departments into one independent company.

“It was distributed in various areas and entities of BASF, in different forms, so the deal was maybe the most complicated that you can imagine,” Back said. “It was a mix of a share deal and an asset deal – part of the business was departments within the larger corporation of BASF, so we couldn’t take over the company with shares, we needed to buy out the asset, which led to a super complex situation.”

There is more to Forward AM than just Heidelberg too. What Back and his colleagues had acquired was a set of assets that made up a global business serving global customers, headquartered in Germany but with a business presence in the United States and France too. The acquisition, therefore, needed to receive approval from government authorities in those countries to adhere to Foreign Direct Investment (FDI) rules.

Forward AM had been told that the Committee on Foreign Investment in the United States (CFIUS) and France’s FDI authority would approve the acquisition within 30 to 45 days. It would take nearly four months.

The company was still able to do business in these regions, but it had disrupted its plans to procure more investment in the second half of 2024.

“Until we had [their approval] we could not completely close the deal, we did not have one carved-out business,” Back explained. “That was providing a problem in terms of fundraising, because when we carved out the business, we had a certain plan, and I wanted to continue and go for the next [investment] round. This has been made much more difficult.”

It wasn’t the only spanner in the works. Forward AM was about to feel the effects of macro market conditions too. Ever since Back had come into the Forward AM business a couple of years ago, he had known only growth. The company would often win new business, support their customers to increase the volumes of parts being additively manufactured and find the next purchase order was greater than the last.

But this year a new trend was emerging. Customers continued to purchase materials, but they did so in lesser volumes. Back says there were two channels where growth was stunted – service bureaus and machine maker businesses – especially in Germany and Western Europe. The 30% growth rate Forward AM boasted in 2022 and 2023 will this year only be approximately 15% – ‘much less’ than what the company’s pipeline had indicated at the start of the year.

“What we saw were a lot of delays, stops on projects and customers who went out of business. This hit us,” Back said. “You have less revenue than you planned. You have no complete business because you’re waiting for CFIUS and FDI filings. And you have limited capability in reacting to the new economic reality.”

For Forward AM, the new economic reality is one where many manufacturers are seeing CapEx budgets trimmed, purchase orders not being signed off and, as a result, less need to buy material products from the likes of Forward AM. Meanwhile, materials manufacturers operating out of China are offering ‘insane volumes and prices’ for materials, undercutting the approach taken by the likes of Forward AM of ‘engineering products and trying to make them the standard in an application.’ That latter approach requires heavy investment at the front end and is considered a long-term business model where the returns come much further down the track. It is pretty safe – ‘if you don’t make mistakes on the way’ – but the challenge for Forward AM is that investors might want an earlier and faster return.

And that challenge is more pertinent now than it has ever been for the company.

Resolve and evolve

While the start of November saw Forward AM receive the relevant FDI approvals to fully complete the acquisition, the effect of the delay was already being felt. By the end of the month, Forward AM had no choice but to apply for insolvency.

Per German law, a company is considered insolvent if it cannot pay obligations that are due or if it is over-indebted and not able to cover existing liabilities. Forward AM, Back says, can cover its day-to-day costs, but if the owners closed the business tomorrow, its assets would not cover its outstanding financial obligations. As a result, Forward AM entered a three-month preliminary insolvency phase towards the end of November.

Once insolvency proceedings have been opened, an insolvency administrator is appointed to manage the debtor’s (Forward AM) property and engage with creditors (investors, lenders, suppliers and service providers) to develop a restructuring plan. The administrator is the person who will clear assets that aren’t the property of the debtor and pay wages to employees of the debtor, but it will be the creditors who make the key decisions on whether to wind up the business or continue. The insolvency administrator will have to comply with this decision, which is usually decided by a majority vote.

However, both Forward AM and the insolvency administrator – Tobias Wahl, a lawyer who specialises in insolvency and restructuring law – have suggested the business is in a place where it should be able to continue. Wahl has been quoted as saying: “The conditions for the continuation of the company are in place. Business operations are stable, and we are committed to promptly working toward a long-term restructuring solution.”

With the preliminary insolvency stage commencing in November, the remainder of that month has been counted as the first month, with December and January rounding out the period. Forward AM will therefore enter the final insolvency stage on February 1st if it is deemed to have sufficient assets to – at the very least – cover the costs of the insolvency proceedings.

Forward AM is using the next six weeks to negotiate with key stakeholders and prepare a plan that can preserve the business. Any insolvency plan will include detail on how creditors will be paid back, and will likely need new investment to be pumped into the company. Working towards the implementation of that plan will then occur if the insolvency administrator’s evaluation of the business points towards it being able to be restructured, but the plan will only become effective with a majority of creditors voting in favour of it.

Back would not be drawn on what happens if a plan could not be developed and the investment the company is seeking cannot be secured – there are many scenarios that could play out – but did tell TCT he is confident a solution can be found.

He said: “There are all kinds of things [that could happen] but I’m pretty confident, based on the initial feedback and interest that we have, and the statements of how important we are for the industry from customers and competitors, that there will be a solution which will be the right one for the industry and for us.”

Radical pragmatism

Throughout the 45-minute conversation regarding Forward AM’s precarious position, Back is calm and measured, choosing his words carefully and maintaining his perspective.

It is perspective from where he draws confidence. As he explained, the insolvency proceedings have not come about because the company isn’t bringing enough money in. Customers are still ordering products – albeit in lesser volumes than anticipated – and Forward AM is still able to fulfil those orders. The business as it is supposed to function is functioning.

Instead, it finds itself in this position because it was unable to secure the funding in time to cover its obligations, owed to delays in FDI approvals. Things could have panned out very differently this year, if not for factors beyond the company’s control.

The solution for Forward AM is now to take better care of what it can control. Back is therefore setting out a strategy of radical pragmatism, ambitious in its objectives but careful and conservative in its strategic approach.

In discussing the long-term payoff for materials providers, Back expressed some frustration with the way that the additive manufacturing industry approaches application development with clients. A lot of time and effort supporting manufacturers has gone unrewarded financially, with OEMs seeing a return only when the manufacturer buys a machine and materials suppliers only when the application scales over a longer period of time.

BASF, Back says, had the resources to make that process more palatable, but as a smaller entity, Forward AM has a greater incentive to speed up the time it takes for manufacturers to adopt, apply and qualify additive manufacturing for their applications.

It is a frustration today that these things can take so long but it still offers promise for the future. As time goes on, those payoffs are getting closer for Forward AM, which is providing Back and his colleagues with assurance as they wade through these choppy waters.

“We have great materials, they are in the market, they have customers, and many of those use cases where our materials are qualified are at the beginning of the lifecycle,” he said. “This is how we expect growth. There is a pretty stable core, and this is what makes me confident.”

There is also confidence in the Forward AM product offering and its role in the additive manufacturing ecosystem. Back was buoyed again when fellow Formnext attendees remarked how they had spotted Forward AM materials on a wide selection of booths at the show. Wind turbine components, footwear insoles, injection moulding tooling, prosthetic sockets, motorsport brake parts and helmet liners have all used Forward AM materials in the last 12 months alone, while Merit3D’s now-famous manufacture of over 1 million hanger components leaned on the Ultracur3D EDP 1006 material.

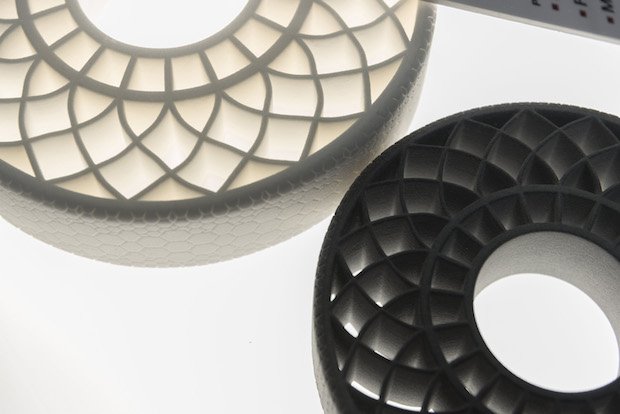

Forward AM has become an important supplier in this space, but that doesn’t mean there won’t be changes. The company takes pride in the progress made with its materials product portfolio since 2017 –boasting more than 60 materials across extrusion, resin-based and powder bed 3D printing processes – but has now suggested it will lean out this offering. Back told TCT the portfolio was perhaps ‘too broad’, and it would be ‘focusing on the top 50%’ of materials moving forward.

It is a decision being made in line with the company’s radical pragmatism approach. Again, Forward AM is proud that for seven years now it has been more than just a materials supplier, supporting customers through application identification and development. But, Back says, the pace of adoption of those applications is ‘not giving the return on investment that the market would require.’ It means, at least for Forward AM, the plan is not to run before it can walk or shoot for the stars before it can fly.

Additive manufacturing, the company believes, will run and will reach the stars, but to achieve such radical feats the companies in this industry need to embrace more pragmatic approaches.

After recent events, that realisation has been brought into sharp focus in Heidelberg, Germany.

“We need to focus on where the money is for our customers and what they need now is improvement soon and fast,” Back finished. “Our customers are being hit by the VUCA (volatility, uncertainty, complexity, ambiguity) world, the volatility and uncertainty are hitting big time, and that should be the time for additive manufacturing to show the strengths of reacting fast to changing parameters. This is where we want to help, provide support with our materials and find solutions that have an immediate impact.

“This is radical pragmatism, and I will adapt the organisation towards that, but also towards a more humble or more conservative understanding of how fast adoption rates can be.”