(Zakharchuk/Shutterstock)

Investment advisors are expanding their use of alternative data thanks to generative AI and the competitive advantages they plan to obtain through it, according to the latest report on alternative data from Lowenstein Sandler.

Alternative data is the investment arena refers to anything that doesn’t appear in company filings, press releases, analyst reports, and other traditional sources. Investors are looking to alternative data like company credit card transactions, geolocation, mobile device data, and social media in order to gain a potentially lucrative signal that can be exploited for competitive advantage.

Lowenstein Sandler is a law firm that has been surveying investment advisors in hedge funds, private equity firms, and venture capital funds about their use of alternative data since 2019. The company detected a surge in the use of alternative data in 2023, when the number of people in its survey affirming the use of alternative data doubled from the previous year, going from 31% to 62%.

The company recently shipped its 2024 report, titled “Alternative Data Poised for More Growth in the Age of AI,” and the trend has continued. Sixty-seven percent of the 103 people surveyed by Lowenstein Sandler (composed of 95% private equity firms, 2% hedge funds, and 3% venture capital firms) affirmed that they use alternative data. The percent of people saying they’re making “significant use of alternative data” increased from 43% in 2023 to 54% in 2024, while those making moderate use declined 9%.

What’s more, 94% of current alternative data users say they are increasing their budgets for the data type, while 87% say their firm now has a formal policy around its use (and 68% have adopted policies about using alternative data with AI). These data points indicates alternative data has achieved a foothold in these firms.

The emergence of generative AI is playing a role in the expansion of alternative data. According to the report, 61% of survey respondents say they use AI for investment research, portfolio optimization, or trading, while 58% say they use it for summarizing research and materials. Among respondents already using AI for investment and trading purposes, 85% say they’re going to expand their use of it in the next year. Among those not using AI, 43% plan to adopt it for next year, the report says.

“Alternative data is no longer novel, but the combination with AI creates the possibility for original insights at a scale and speed that was previously unattainable,” says Scott H. Moss co-chair of the investment management group at Lowenstein Sandler. “We have entered a new era of investment that will be shaped in large part by technology’s exploitation of data.”

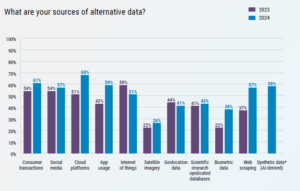

Alternative data can come from a range of sources. The sources that saw the biggest percentage point increases from earlier surveys came from cloud platforms (17%), app usage (17%), biometric data (16%), and Web scraping (20%), the company says.

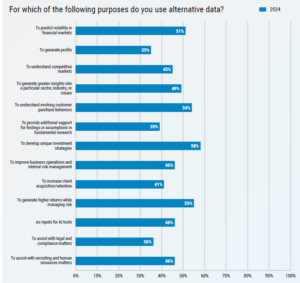

Investment firms are using their alternative data for a variety of use cases. The top three use cases were: developing unique investment strategies, generating higher returns while managing risk, and understanding evolving customer purchase behaviors, according to the report.

Survey respondents say they obtain their alternative data comes from a variety of sources, the top three being cloud platforms, consumer transactions, and app usage. Synthetic data (which wasn’t an option in 2024) was number four on the list, followed by social media, with Facebook, Instagram, and X being the leading sources.

While alternative data can generate alpha, it doesn’t come without risks. The top concern that firms have when it comes to alternative data are data ownership and privacy issues, cited by 36% of survey respondents. There was a three-way tie for second place at 33%, shared by data security/breach, risk of acquiring material non-public information, and increased compliance burdens, the survey shows.

Among the one-third of firms not using alternative data, there were several reasons for why they don’t use it. Locked in a four-way tie at 35% were lack of trust in the quality of the data, too expensive, regulatory/compliance risk, and technical difficulties working with the data.

Related Items:

Alternative Data Isn’t So Alternative Anymore

Bloomberg Makes Alternative Data Accessible Alongside Traditional Financial Data

Alternative Data Goes Mainstream in Financial Services