This post is part of an ongoing “What Is” series from Energy Innovation that answers some of today’s most pressing climate policy questions. The first in this series answered the question–What is Net-Zero?.

What is the Inflation Reduction Act graphic by Energy Innovation

What Is The Inflation Reduction Act?

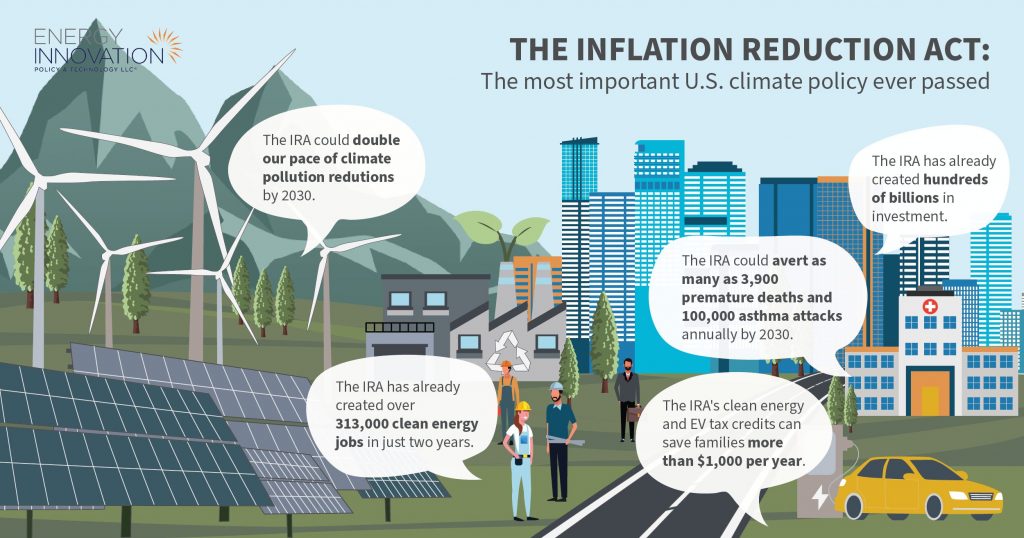

The Inflation Reduction Act (IRA) is the most important climate legislation in United States history. President Biden’s signature climate achievement is giving Americans the choice to stop burning fossil fuels, cutting energy bills, kick-starting a domestic manufacturing boom, cleaning the air and water, and creating hundreds of thousands of good jobs.

Clean energy incentives in the IRA empower the U.S. to transition off fossil fuels through $369 billion in new spending that bolsters clean energy projects, which Goldman Sachs estimates will catalyze $2.9 trillion cumulative investment by 2032. This all happens by investing in agriculture, clean energy, manufacturing, and forest management.

These investments are paying off. Initial modeling by Energy Innovation forecast IRA provisions could create more than a million net new jobs in 2030 and increase GDP by up to $200 billion in 2030. As of June 2024, clean energy investments catalyzed by the IRA have created more than 313,000 new jobs and more than $360 billion in project announcements, primarily in rural and low-income communities. Every $1 of federal funds invested in clean energy is stimulating $5-$6 in private investment, and analysis shows more than three-quarters of all factory and mining investments since the IRA was signed is flowing into Republican congressional districts.

The IRA has helped more than double America’s greenhouse gas emissions reduction pace compared to 2020, put the country within striking distance of its national climate goals, and fueled a homegrown clean energy boom. But unlike past economic recoveries, increased clean technology deployment is decoupling U.S. job and economic growth from greenhouse gas emissions – the U.S. is now on track to cut GDP greenhouse gas intensity 57% by 2030 compared to 2005 levels

That all means Americans can breathe cleaner air today, and will experience a safer climate future tomorrow.

What Benefits Has the Inflation Reduction Act Already Created?

No matter what city or state they live in, every American wants to breathe clean air, drink clean water, have affordable energy bills, and have a good job. The IRA enables the federal government to work closely with local, state, and tribal governments to help resolve community concerns like pollution, reliable energy access, clean air and water, and provide employment.

IRA provisions help unique community needs across the U.S. by empowering states to create bespoke solutions for their citizens. These include investments to add new clean energy generation, build clean manufacturing facilities, deploy affordable clean vehicles, strengthen America’s electric grid, and make our homes more resilient against extreme weather.

The IRA is also generating consumer benefits. Supporting a cleaner grid cuts energy costs: The White House initially estimated that families who advantage of clean energy and electric vehicle tax credits will save more than $1,000 per year. The Internal Revenue Service reports more than 3.4 million American families have already claimed $8.4 billion in residential clean energy and home energy efficiency credits against their 2023 federal income taxes, saving up to $3,100 per year based on the installed technology. And the U.S. Treasury reports the IRA has already saved consumers $1 billion on electric vehicle sales,

This clean energy economic boom also proves combating climate change is profitable. In the last two years private companies have invested hundreds of billions into U.S. clean energy and transportation projects. Most of these projects are located in five states – Michigan, Texas, Georgia, California, and South Carolina.

Actions That Have Maximized IRA Benefits

In the two years since it was signed, U.S. Treasury data shows implementing IRA provisions has significantly benefited local economies, spurring hundreds of millions in manufacturing investments:

- 81 percent of clean investment dollars since the IRA passed land in counties with below-average weekly wages.

- 70 percent of clean investment dollars since the IRA passed are in counties where a smaller share of the population is employed.

- 78 percent of clean investment dollars since the IRA passed flow to counties with below-average median household incomes.

- 86 percent of clean investment dollars since the IRA passed are landing in counties with below-average college graduation rates.

- The share of clean investment dollars going to low-income counties rose from 68 percent to 78 percent when the IRA passed.

- The IRA has provided more than $720 million in support for Tribal communities as they transition to renewable energy enabling them to become more climate resilient.

IRA provisions have jump-started clean transportation as America’s vehicle fleet transitions from expensive fossil fuels to affordable electric power.

- Income-eligible consumers receive a credit of up to $7,500 to purchase new electric vehicles, including light- and medium-duty trucks along with personal vehicles, and new electric vehicles are now more affordable than conventional gas cars.

- Electric vehicle sales have accelerated to more than 9 percent of total U.S. vehicle sales and are on track to hit 11 percent of total sales this year – up from roughly 2 percent in 2020.

- Automakers and battery manufacturers have announced $88 billion in new domestic factories to produce electric vehicles and their supply-chain components, enhancing our global competitiveness by building a “Battery Belt” across the Midwest and Southeast U.S.

Rebates for buildings and homes are helping U.S. households lower energy costs, improve housing affordability, cut carbon emissions, and enhance social equity.

- The IRA allocated $8.8 billion in federal funding for home and building rebate programs, targeting the one in seven U.S. families who live in energy poverty.

- The Home Electrification and Appliance Rebates (HEAR) program dedicates $4.5 billion to help low- and middle-income households adopt energy-efficient equipment like heat pumps and water heaters, as well as energy efficiency measures like insulation and air sealing.

- The Home Efficiency Rebates (HOMES) program provides $4.3 billion for energy-saving retrofits for single-family and multi-family households, with double the incentives for low- and middle-income homes or dwelling units in multifamily buildings.

- The 45L Energy Efficient Home Credit offers incentives for builders to construct U.S. Environmental Protection Agency-certified Energy Star and U.S. Department of Energy (DOE)-certified Zero Energy Ready homes, while the HEAR and HOMES programs offers dedicated incentives for contractors that do the work, provided the installation is done in a disadvantaged community.

Electricity is having an infrastructure renaissance as much of the expected IRA impact is from the electricity sector, especially the tax credits.

U.S. industrial emissions are on track to be the country’s biggest polluter within a decade, but IRA provisions are powering a Made-in-America clean industrial renaissance.

- IRA funding includes a nearly $6 billion dollar investment to transform America’s industrial sector through the U.S. DOE’s Industrial Demonstrations Program. This funding will commercialize new technologies meant to cut industrial emissions.

- The IRA also allocates more than $4 billion dollars to green public procurement programs for low carbon materials like asphalt, concrete, cement and glass.

- The new 45X advanced manufacturing production tax credit expands domestic production of specific components for wind, solar, and batteries. It also covers the production of thermal batteries, which can eliminate emissions from industrial process heating and cut its costs by two thirds.

- The new 48C project credit directly incentivizes emissions reduction by offering a 30 percent investment tax credit for projects that retrofit an industrial facility with equipment that reduces emissions by at least 20 percent. It also offers a 30 percent investment tax credit to projects that retrofit, expand, or establish new industrial facilities to manufacture clean energy technologies or critical minerals.

- The IRA granted additional loan authority to DOE’s Loan Programs Office, enabling financing for early deployments of innovative industrial technologies.