Global EV Market Ups and Downs

According to the IEA, 2023 was a record year for EV sales, reaching almost 14M car sales or 18% of all cars sold. 2024 promises continued growth, with EV sales up 25% in Q1’24 compared to Q1’23. Market share of EVs could reach up to 45% in China, 25% in Europe, and 11% in the U.S.

These promising statistics do not reflect the underlying challenges and tensions in the EV sector.

Major auto OEMs are pulling back on electrification targets (e.g., Mercedes) and potentially closing down EV production plants citing low demand. Intensifying price wars between North American/European OEMs and Chinese EV manufacturers are forcing all players to implement price cuts, reflecting losses that auto OEMs may be unable to absorb. Despite incoming tariffs on EVs imported to Europe and the U.S., Chinese auto OEMs are churning out EVs at speeds and price points that western OEMs cannot match.

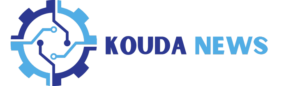

Industry Forces in Current EV Motor Market

The Climate Challenge

EV adoption is currently the most critical step to decarbonizing road transportation. Meeting EV adoption goals, however, strains both critical materials and energy resources. EVs will be one of the largest new loads on local grids and are projected to make up 6% – 8% of energy demand by 2035 (up from .5% in 2024).

Rare earth metals are used in most EV motors (4-12 lbs./vehicle on average). The extraction, refining, and production of one ton of rare earth metals produces one ton of radioactive waste in addition to the associated mining emissions.

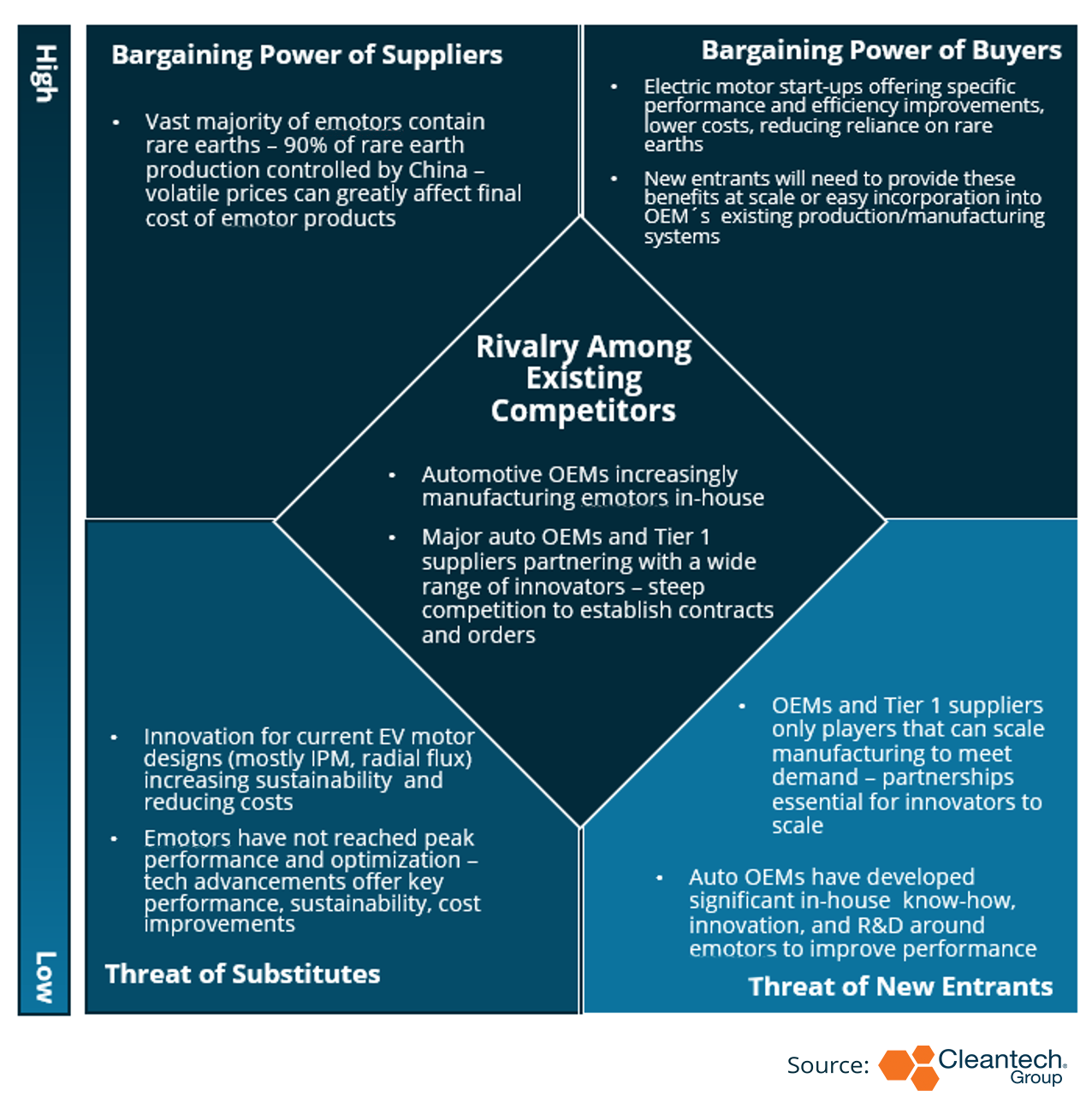

Rare earth metals are also a supply chain nightmare, with 90% of output controlled by China. They are subject to significant price volatility and a key supply chain insecurity for many western automakers.

Global Rare Earth Element Supply

EV Motor innovation: the Incoming EV Revolution

Recently, battery advancement to improve range and reduce charging times has been the focus of EV innovation. However, a new generation of sustainable, high efficiency, high performance EV motors is rapidly approaching commercialization.

Advanced manufacturing, design, and component innovation is enabling OEMs and innovators to cost-efficiently produce motor design such as axial flux, synchronous, and switched reluctance motors, that were previously impractical due to cost, size, or power constraints.

These motors will result in EVs that use less energy, require fewer materials, have a lower climate impact, and can reach the market faster with lower final price tags.

Key Innovation Impacts

Innovators are poised to:

- Significantly reduce time to market and production costs

- Advanced manufacturing and design (e.g., Additive Drives)

- Flexible and optimized vehicle architectures (e.g., Daanaa)

- Lower climate impact of motors and vehicles

- Facilitate electrification of heavy-duty sectors such as industrial and commercial vehicles, maritime, and aviation (e.g., 4QT, ZPARQ)

Key Dynamics and Trends to Look Out For…

- Widespread market uptake of new generation EV motors in 2-5 years

- Challenges will remain to cost-effectively scale manufacturing, particularly for motors with complex designs and production processes (e.g., axial flux motors)

- Auto OEMs will have motor expertise and will increasingly manufacture motors in-house:

- Acquisition of innovators and technology licensing will be most attractive for OEMs

- Innovators with IP that involves streamlined manufacturing (e.g., for several product lines) have a key value proposition for OEMs

- First market identification will be key for innovators:

- Favorable markets include regions with high rates of electrification and competition (e.g., Indian 2-and-3 wheeler market)

- Also favorable are lower-volume markets that do not require immediate scaling of manufacturing (e.g., specific commercial or industrial sectors)

- Supply of zero-emissions commercial vehicles will not be adequate to meet demand: An opportunity will exist for innovators to partner with Tier 1 suppliers to provide end customers with vehicles that meet incoming mandates

- Increasing electrification of maritime and aviation: Expect incumbent innovation in electric motors for these use-cases as well as acquisitions of innovators addressing aviation- and maritime-specific challenges

Innovator Spotlight:

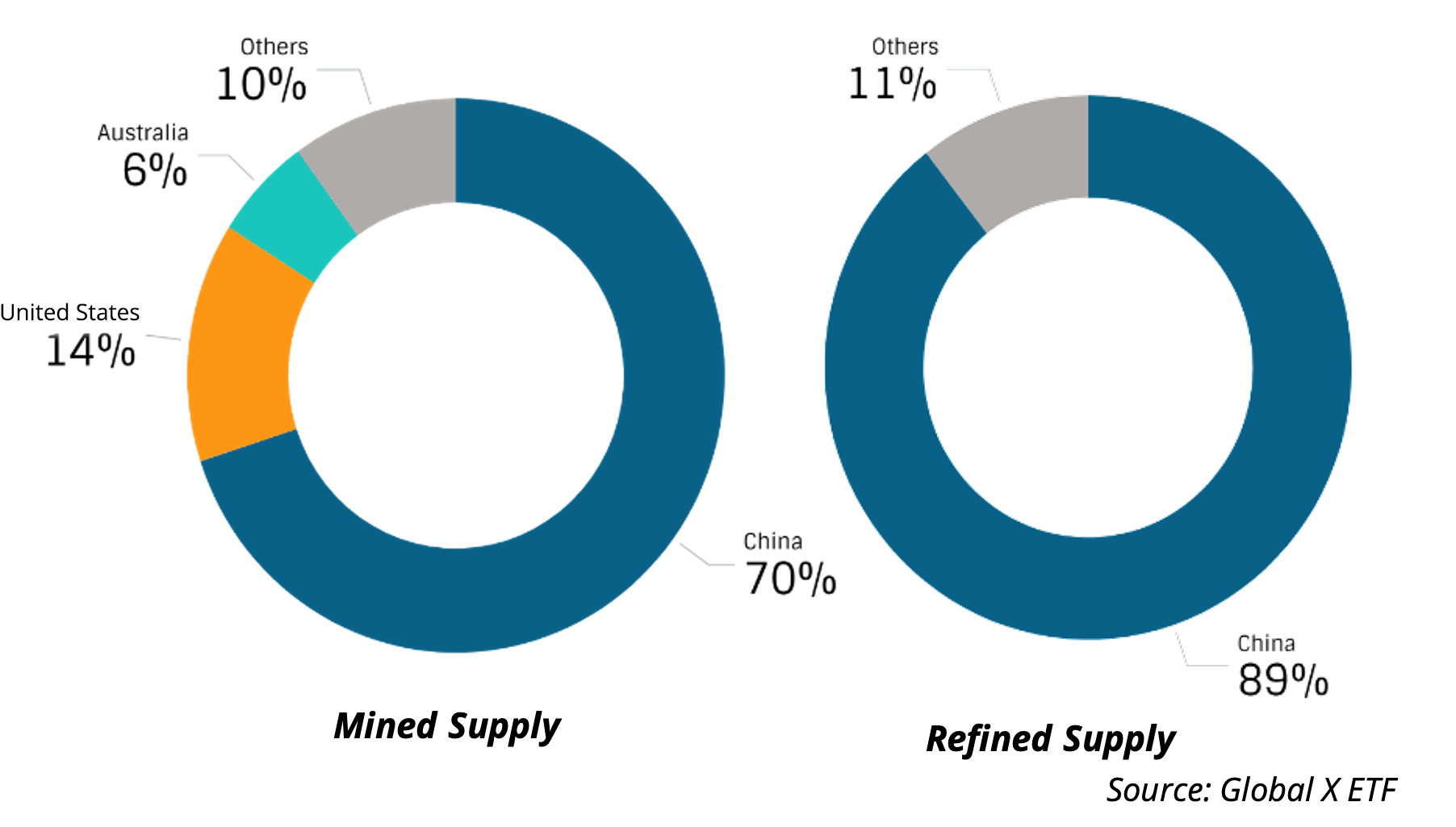

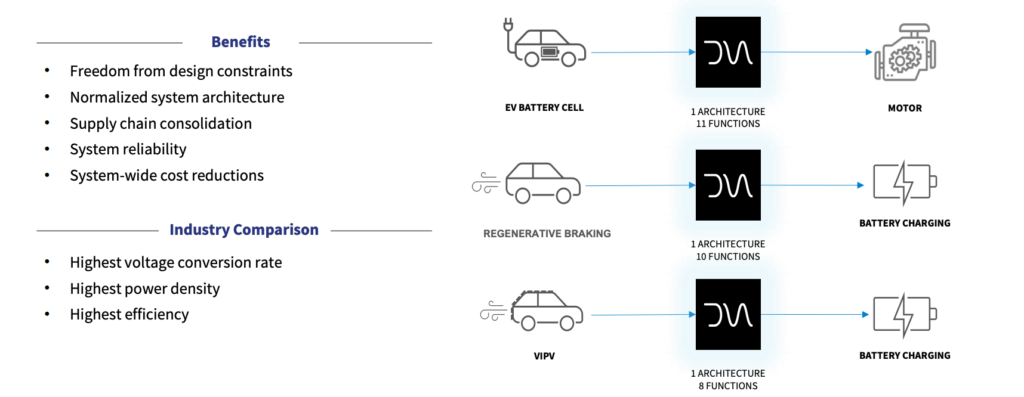

Power electronics developer Daanaa is addressing the challenges of both electrical and operational efficiency for EV developers at the component level. Their proprietary chip technology consolidates power electronic functions into a single-step process, enabling higher efficiency voltage conversion for use cases up to 1500V. While the applications for power electronics and energy conversion technologies span from solar panels to household electronics, Daanaa´s solutions address several of the key pain points EV OEMs are currently facing: reducing time to market, improving vehicle sustainability, and lowering the final price of vehicle products.

Conventional Vehicle Systems: Heterogenous and Inefficient

Daanaa develops vehicle architectures based on their integrated power transaction unit (PTU), which combines a range of vehicle functions into one system. The result is increased motor efficiency and battery optimization, reduced systemwide energy loss, and simplified design processes and supply chains.

CEO Udi Daon emphasizes the potential impact on production cycles and costs, noting that currently, each system in EVs require their own supply chain, design, production, and manufacturing lines. Daon envisions that with Daanaa´s vehicle architecture, OEMs could drastically reduce time-to-market consolidating manufacturing lines, design cycles, and component production, while delivering a higher-efficiency vehicle with a longer range and battery lifetime.

Next steps

Currently the process of developing and integrating vehicle architecture solutions is based on the specific OEMs requirements, and work with Tier 1 suppliers to produce the required semiconductor components. Look for innovators to examine tech applications for development of small, light high-voltage motors to increase efficiency, sustainability, and performance.